We are a leading, growth-focused private equity firm based in the Nordics

Companies we find attractive

Growth potential

We invest in companies operating in fundamentally attractive market segments and with leading market positions. These companies should have significant growth potential, either through organic initiatives or strategically-attractive acquisitions.

Partnership

We are particularly interested in situations where an entrepreneur or a management team is seeking an experienced and value-added partner to support them on their continued growth journey.

Nordic middle market

The companies we invest in generally have revenues of €10 million to €300 million and usually have meaningful operations in at least one of the Nordic countries.

Sectors we focus on

Tech & Software

Tech & Software

Examples: Software-Enabled Services, Managed Services, Digital Marketing Services & Software, Enterprise Software Solutions

Business Services

Business Services

Examples: Technical Installation, Safety & Inspection, Property Maintenance & Refurbishment, Security Services

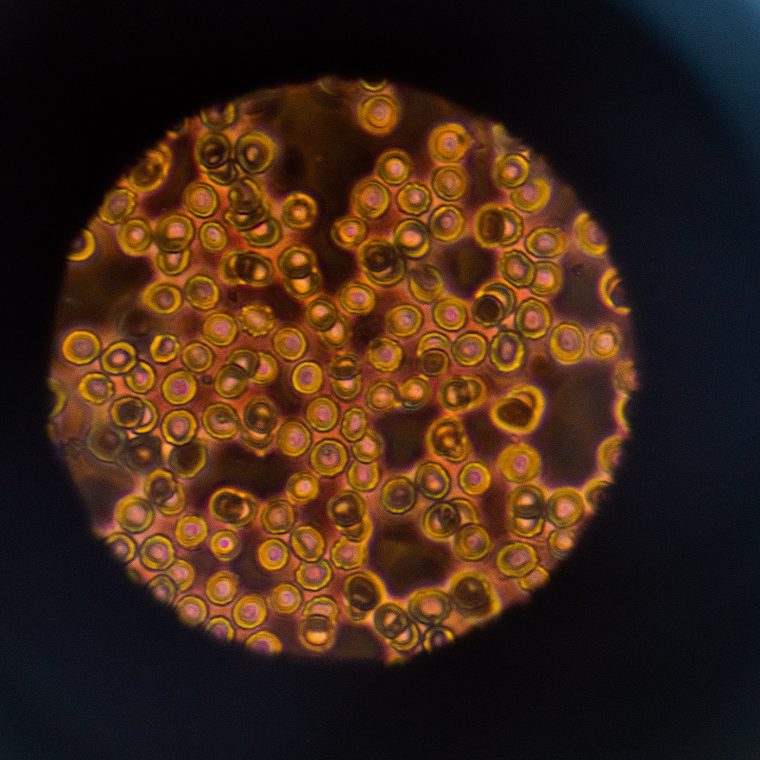

Health & Life Science

Health & Life Science

Examples: Diagnostics, Pharma Services, Healthcare Services

Funds

Endowments

Funds

Broad and long-term investor base

We are significant investors ourselves in all of our funds, and with 8% of the capital the single largest investor in our most recent fund. Our external investors are primarily pension funds, life insurers, foundations and endowments in Europe and North America. Most invest directly into Adelis, others invest indirectly via fund of funds.

Our most recent fund, Adelis Equity Partners Fund III AB, was raised in 2021 and has total commitments of EUR 932 million. Our total assets under management (AUM) amount to more than EUR 2 billion.